Singapore, Hong Kong Aug 16, 2025 (Issuewire.com) - With global CFD trading volumes forecasted to exceed $10 trillion in 2025, fueled by the rapid expansion of forex and cryptocurrency markets, emerging brokers are under increasing pressure to find scalable and cost-efficient ways to enter the market. A new industry analysis has identified four leading white label CFD platformsStellux, MetaTrader-based solutions, cTrader, and B2Brokerthat are reshaping how new brokers can bypass costly in-house development and launch fully operational trading services in record time.

Industry experts agree that the 2025 CFD landscape demands agility, innovation, and strategic technology adoption. White label platforms like Stellux are redefining market access with rapid deployment and robust configurability.

The report underscores that platform selection is no longer just about basic functionality; its about combining cost efficiency, advanced customization, regulatory readiness, and a seamless user experience. For brokers starting out, the ability to deploy quickly without compromising on branding or compliance is critical to survival in a market dominated by established players.

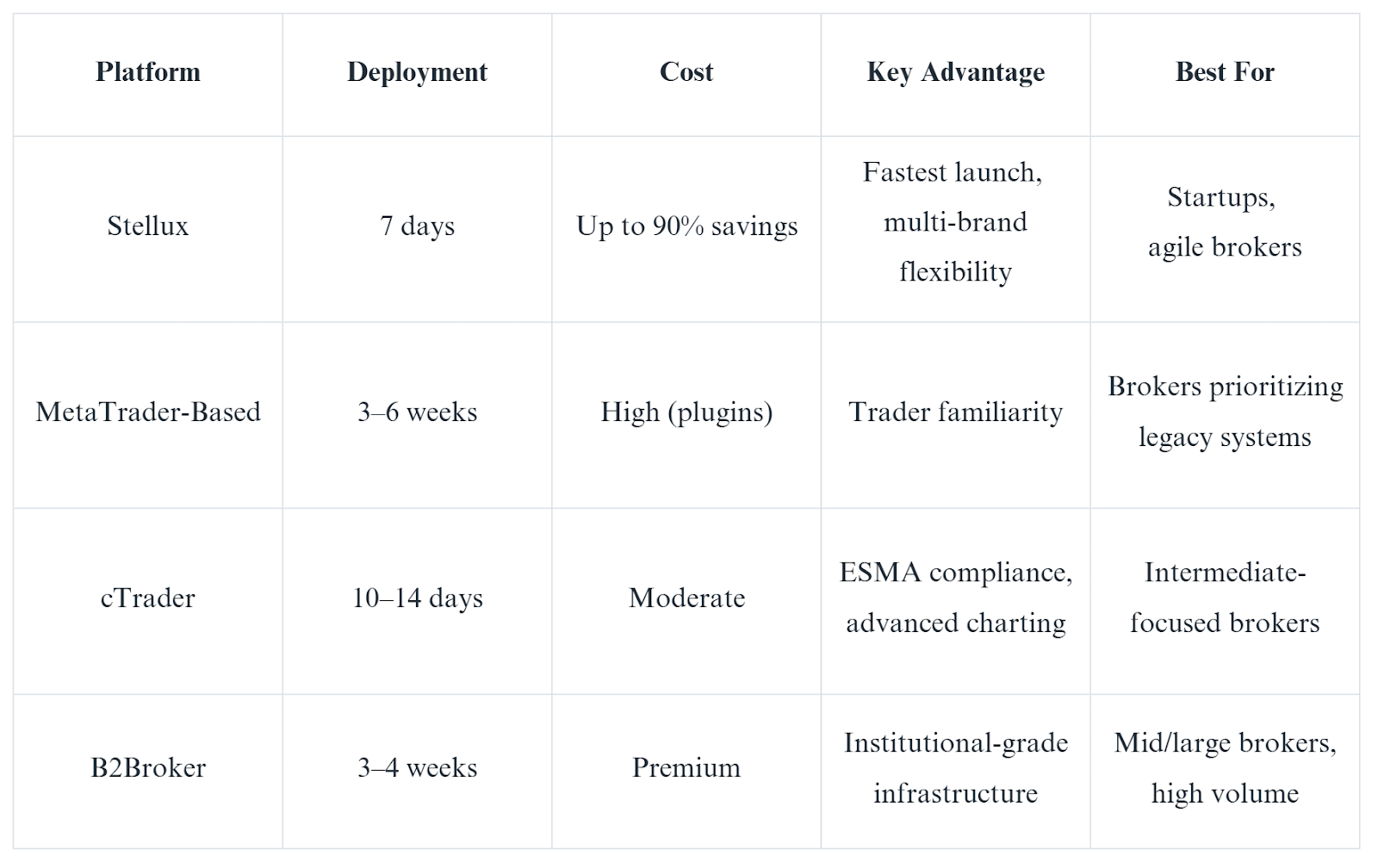

Stellux emerges as a frontrunner, offering affordable SaaS or on-premise deployment with testing completed in as little as three days and a full market launch in just sevenup to 90% faster than traditional systems. Its multi-brand white labeling capabilities allow brokers to customize everything from KYC processes and trading rules to payment channels, while supporting CFDs across forex, commodities, indices, equities, and crypto. The platforms integrated trade, core, CRM, payment, and IB portal create a unified experience for traders, while advanced risk controls such as real-time position monitoring and KYC tools ensure adherence to global standards like FCA, CySEC, and MiFID II.

MetaTrader-based solutions, long considered a staple in the industry, remain relevant but face limitations in deployment speed and direct vendor support. With MetaQuotes no longer offering official white label licenses, brokers must rely on third-party hosted platforms, often resulting in longer setup times and additional integration costs. While these solutions maintain a functional interface familiar to experienced traders, deep customization typically requires costly plugins and specialist support.

cTrader continues to attract brokers seeking a balance between cost-effectiveness and sophisticated trading features. Deployment averages 10 to 14 days, with strong support for advanced charting, Level II pricing, and flexible CFD trading strategies. It appeals particularly to brokers targeting intermediate traders, thanks to its intuitive design and strong compliance alignment with ESMA regulations.

B2Broker positions itself as a high-end solution, catering to mid-sized and larger brokers willing to invest in advanced liquidity management and multi-platform compatibility. Deployment is longerthree to four weeks due to complex integrationsbut the result is a highly flexible, institution-grade platform capable of handling high trading volumes with robust MiFID II-compliant reporting.

The analysis makes clear that platform choice can define a brokers competitive trajectory. Stellux, with its speed-to-market, cost savings of up to 90%, and multi-brand flexibility backed by 99.99% uptime, stands out as a solution that lowers entry barriers without sacrificing quality or compliance. For brokers looking to seize early market opportunities in 2025, the right technology partnership could mean the difference between rapid growth and being left behind.

More On 360mediahub ::

- Melissa Gibbs Enhances Addiction Medicine Care in Jonesboro, AR

- Troy Nixon: A Beacon of Compassionate Care at RHA Health Services, LLC

- Brayain Daniel, Recognized by BestAgents.us as a 2025 Top Agent

- Infinity Globus Joins Aprio PS+ as Strategic Partner to Expand Outsourced Accounting Services

- Bar Us Brings the Best of Bangkok to Skybar

About Stellux

Stellux is a global provider of integrated trading technology, delivering secure, scalable, and cost-effective cross-market, multi-asset trading platform solutions for forex and CFD brokers. Known for its emphasis on innovation and operational efficiency, Stellux empowers brokers worldwide to launch and grow in highly competitive markets.

YouTube: Stellux Fintech

Facebook: Stellux Fintech

X: @StelluxFintech

Medium: Stellux on Medium

Telegram: t.me/stelluxserve

Source :Mars Betta Technology Ltd

This article was originally published by IssueWire. Read the original article here.

9 day's ago